Understanding the probate process

The world’s top-performing companies leverage the probate process to ensure efficient and effective recovery operations that drive key business results.

Key definitions

Estate: Assets and debts (liabilities) owned solely by the decedent.

Probate: The legal administration of an estate and the associated assets.

Personal Representative: A court-appointed individual interested in representing the decedent’s estate.

Probate Process Overview

1

A probated estate is opened Once a court-appointed Personal Representative is confirmed, he or she will need to publish notice of administration, typically published in a newspaper or other publication of general circulation. This is done so that interested parties know that an estate has been opened in the decedent’s name.2

Creditors submit their right to payment A notice is then “served”, or sent directly to all known or reasonably ascertainable parties, such as your organization. This notification gives you, as well as the other creditors fair warning that the estate has been opened and claims can be filed. Based on our experience, even though there may be a legal requirement to supply notice to creditors, we see that in many cases, a number of creditors are not receiving notice.3

The estate assets are administered A final accounting of estate assets may be created to serve as a guide to make distributions – in the form of cash or assets – to all claimants. Part of the Personal Representative’s job is to liquidate assets to pay claims before distribution and closing. Creditors who have presented claims in a timely fashion with the proper form(s), are entitled to payment to the extent that assets exist.

Probate is time-consuming

Pursuing probate manually can often be time-consuming, costly, labor-intensive, and ultimately not worth the trouble.

Why? The identification of probated estates requires searching 3,215 counties and 3,400+ specific courts. Accessibility varies greatly from county to county, and a majority require costly search or sourcing methods.

To make it even harder, traditional claim filing often requires creditors to comply with and manage dozens of variables relative to each court.

- Claim filing fast facts

3,215

Separate U.S. counties

3,400+

Unique U.S. probate courts

20,000

Claim form variable changes by courts each year

Identifying the trends

Increasing consumer debt, an aging America, among other societal factors, create a need for organizations to collect on decedent debt effectively with an a sensitive approach.

The aging of America

Nearly 70% of American decedents each year fall in the 60+ age group, a population set to nearly double in the coming decades.

Increasing consumer debt

More than 73% of consumers pass away with debt. Baby Boomers, on average, pass away with $6,788 in credit card debt.

Economic uncertainty

Revenue shortfalls, internal revenue constraints, and a rise in unemployment further emphasize the need for utilizing probate.

Identifying the trends

Increasing consumer debt, an aging America, among other societal factors, create a need for organizations to collect on decedent debt effectively with an a sensitive approach.

The aging of America

Nearly 70% of American decedents each year fall in the 60+ age group, a population set to nearly double in the coming decades.

Increasing consumer debt

More than 73% of consumers pass away with debt. Baby Boomers, on average, pass away with $6,788 in credit card debt.

Economic uncertainty

Revenue shortfalls, internal revenue constraints, and a rise in unemployment further emphasize the need for utilizing probate.

- Claim filing fast facts

3,215

Separate U.S. counties

3,450+

Unique U.S. probate courts

20,000

Claim form variable changes by courts each year

Companies can no longer afford to write off decedent debt

How companies collect on decedent debt is different now

Gone are the days of manually searching for decedents in newspaper obituaries. Automating the decedent recovery process is paramount to obtaining a positive return on investment and providing an empathic survivor experience. Organizations may try to collect using an in-house team, but often do not have the necessary resources or time to execute effectively. This approach results in either marginal results or writing off all decedent debt completely.

Industry-leading organizations:

- Utillize data from many different sources

- Prioritize proactive decedent identification

- Autonomously search for open estates

- Effectively manage claim documents

- Follow-up post-claim

- The recoveries process has changed

Companies can no longer afford to write off decedent debt

How companies collect on decedent debt is different now

Gone are the days of manually searching for decedents in newspaper obituaries. Automating the decedent recovery process is paramount to obtaining a positive return on investment and providing an empathic survivor experience. Organizations may try to collect using an in-house team, but often do not have the necessary resources or time to execute effectively. This approach results in either marginal results or writing off all decedent debt completely.

Industry-leading organizations:

- Utillize data from many different sources

- Prioritize proactive decedent identification

- Autonomously search for open estates

- Effectively manage claim documents

- Follow-up post-claim

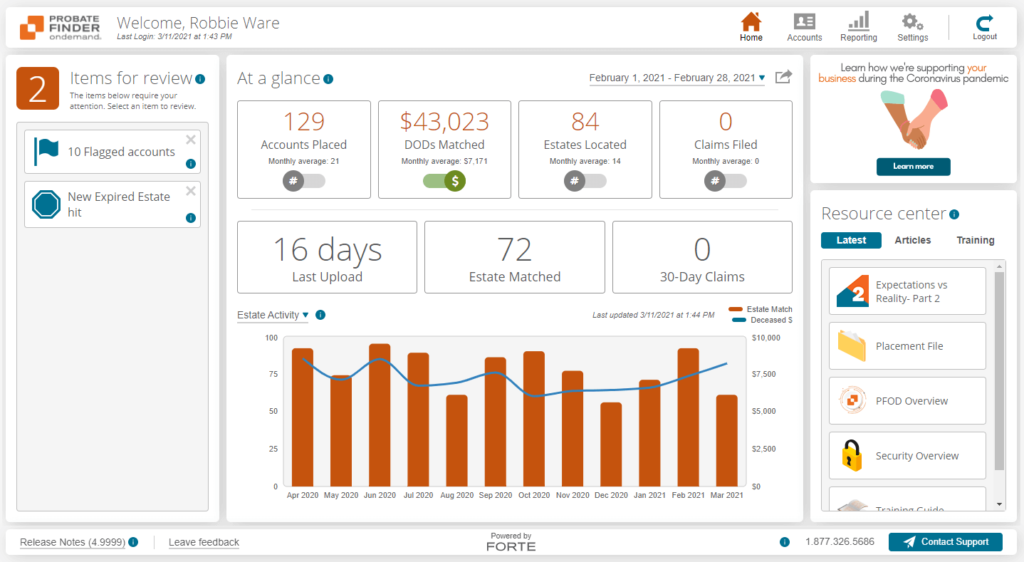

How Probate Finder OnDemand works

Upload accounts

Simply upload all of your accounts and Probate Finder OnDemand will automatically scrub to identify dates-of-death and probate estates.

Identify decedent information

Our proprietary DOD Finder™ database houses 120 million date-of-death records, combining multiple data sources and providing a nearly 20% lift over the Social Security Administration’s Death Master File.

Locate probate estates

Continuous scrubbing of our proprietary Probate Finder® database, combined with multiple database cross-references produces the most accurate source of estate information available.

File probate claims

Automate claim package processing to adhere to the thousands of court-specific requirements, and protect your right to payment through timely probate claim presentation.

- The only online probate claim filing solution

How Probate Finder OnDemand works

Remove manual work and realize positive return-on-investment when pursuing estate recoveries.

Upload accounts

Simply upload all of your accounts and Probate Finder OnDemand will automatically scrub to identify dates-of-death and probate estates.

Identify decedent information

Our proprietary DOD Finder™ database houses 120 million date-of-death records, combining multiple data sources and providing a nearly 20% lift over the Social Security Administration’s Death Master File.

Locate probate estates

Continuous scrubbing of our proprietary Probate Finder® database, combined with multiple database cross-references produces the most accurate source of estate information available.

File probate claims

Automate claim package processing to adhere to the thousands of court-specific requirements, and protect your right to payment through timely probate claim presentation.

See Probate Finder OnDemand in action

With knowledge regarding the probate process, support from an experienced staff of probate collections experts, and the ease of locating and presenting claims that Probate Finder OnDemand provides, our partners are finding revenue in places where they didn’t expect it to exist.

Contact us: 612.243.8412