Increase revenue, improve efficiency, and fairly administer tax laws

Develop specialized, streamlined, automated strategies among your decedent taxpayer accounts.

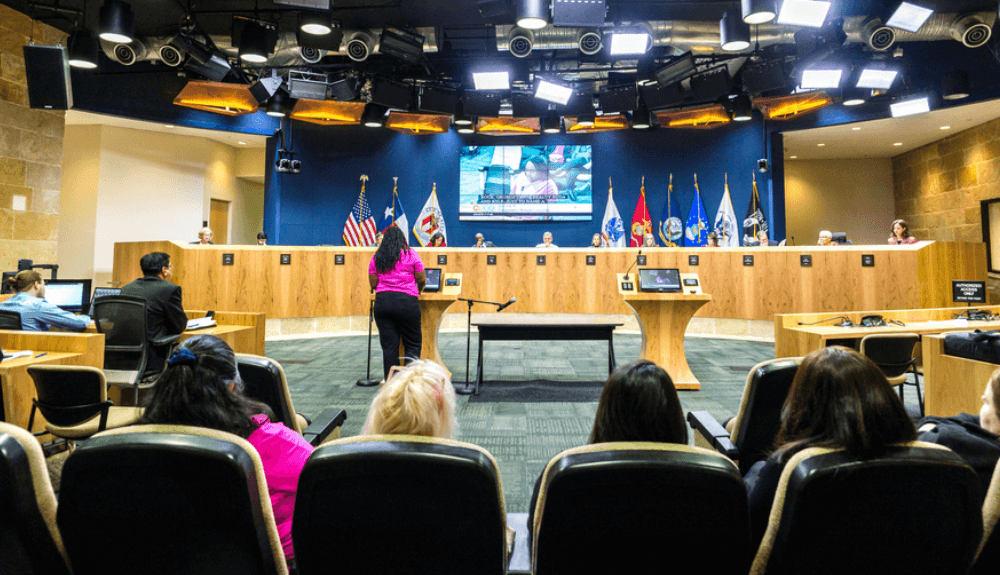

- Government

Increase revenue, improve efficiency, and fairly administer tax laws

Develop specialized, streamlined, automated strategies among your decedent taxpayer accounts.

- Better serve your constituency

Provide an enhanced taxpayer experience

Enhance the taxpayer experience

Properly segment decedent accounts to ensure a survivor-sensitive approach to recovery

Preserve your right to payment

Claims of State and Federal government are often prioritized in state probate codes

Farily administer tax laws

Creation of detailed estate search record-keeping to document, store, and retrieve evidence of regular estate searches and collection efforts

Create process perfection

Remove process inefficiencies that hinder return on investment by streamlining all recovery activities

Refocus resources

Remove manual probate work for your collections team and reallocate resources to more important work

Actionable reporting

Intuitive dashboards coupled with advanced reporting provide actionable insights for your team

- Best practices for governement agencies

Aligning process with mission

Creating a specialized estate recovery process provides transparency and the ability to fairly administer tax laws

The challenge

Government agencies are obligated to administer tax laws fairly, but often do not have the necessary resources to efficient collect on decedent taxpayer debt.

Estate recovery best practices for government agencies

Proactively identify decedent taxpayers

There are many benefits to proactively understanding if a taxpayer has unfortunately passed, including mitigation of fraudulent activity on an account, and ensuring the proper treatment if the account does become delinquent.

Create a process for continuous, automated probate searches

Probate can be opened as late as 3 years from date of death, and 1 in every 5 probated estates is opened outside the address of record. This reality creates a need for automated, nationwide probated estate search that is nearly impossible to achieve internally. Utilizing Probate Finder OnDemand ensures automated, nationwide probate searches.

File compliant and timely claims

Claim presentation preserves your agency’s right to payment, and claims of State and Federal government agencies are often prioritized in state probate codes. Specific to estate recovery, probate claim filing is time sensitive and failure to actively identify deceased accounts can result in enormous loss on the back end. This occurs when front end processes are not efficiently implemented and executed. Probate Finder OnDemand automatically adheres to claim filing variables and provides the opportunity to easily submit a claim.

- Government agencies using Probate Finder OnDemand:

- Fairly administer tax laws for their constituency

- Enhance the taxpayer experience

- Reallocate full-time employees to core business functions

- Mitigate compliance risks

- Preserve their right to payment through probate

See Probate Finder OnDemand in action

With knowledge regarding the probate process, support from an experienced staff of probate collections experts, and the ease of locating and presenting claims that Probate Finder OnDemand provides, our partners are finding revenue in places where they didn’t expect it to exist.

Contact us: 877.326.5686